Preparing Your Finances for Homeownership

Embarking on the journey to homeownership is an exciting milestone, but it requires thorough financial preparation. For potential buyers, understanding and organizing your finances is crucial to securing a mortgage and ensuring a smooth purchasing process.

Embarking on the journey to homeownership is an exciting milestone, but it requires thorough financial preparation. For potential buyers, understanding and organizing your finances is crucial to securing a mortgage and ensuring a smooth purchasing process.

First and foremost, evaluate your current financial situation. This involves taking a detailed look at your income, expenses, savings, and debts. Create a budget that outlines your monthly expenditures and identifies areas where you can cut back to save more for your down payment. Aim to have at least 20% of the home’s purchase price saved up to avoid private mortgage insurance (PMI) and secure better loan terms. While 20% is the gold standard, there are many other options we can explore that require significantly less in the way of a downpayment.

Next, focus on improving your credit score. Lenders use your credit score to assess your reliability as a borrower. A higher score can help you qualify for lower interest rates on your mortgage. To boost your credit score, pay off outstanding debts, keep credit card balances low, and make all payments on time. Regularly check your credit report for errors and dispute any inaccuracies.

When you're ready to start the mortgage application process, gather all necessary documentation. Lenders will require proof of income, tax returns, bank statements, and information about any existing debts. Having these documents organized and readily available can expedite the approval process.

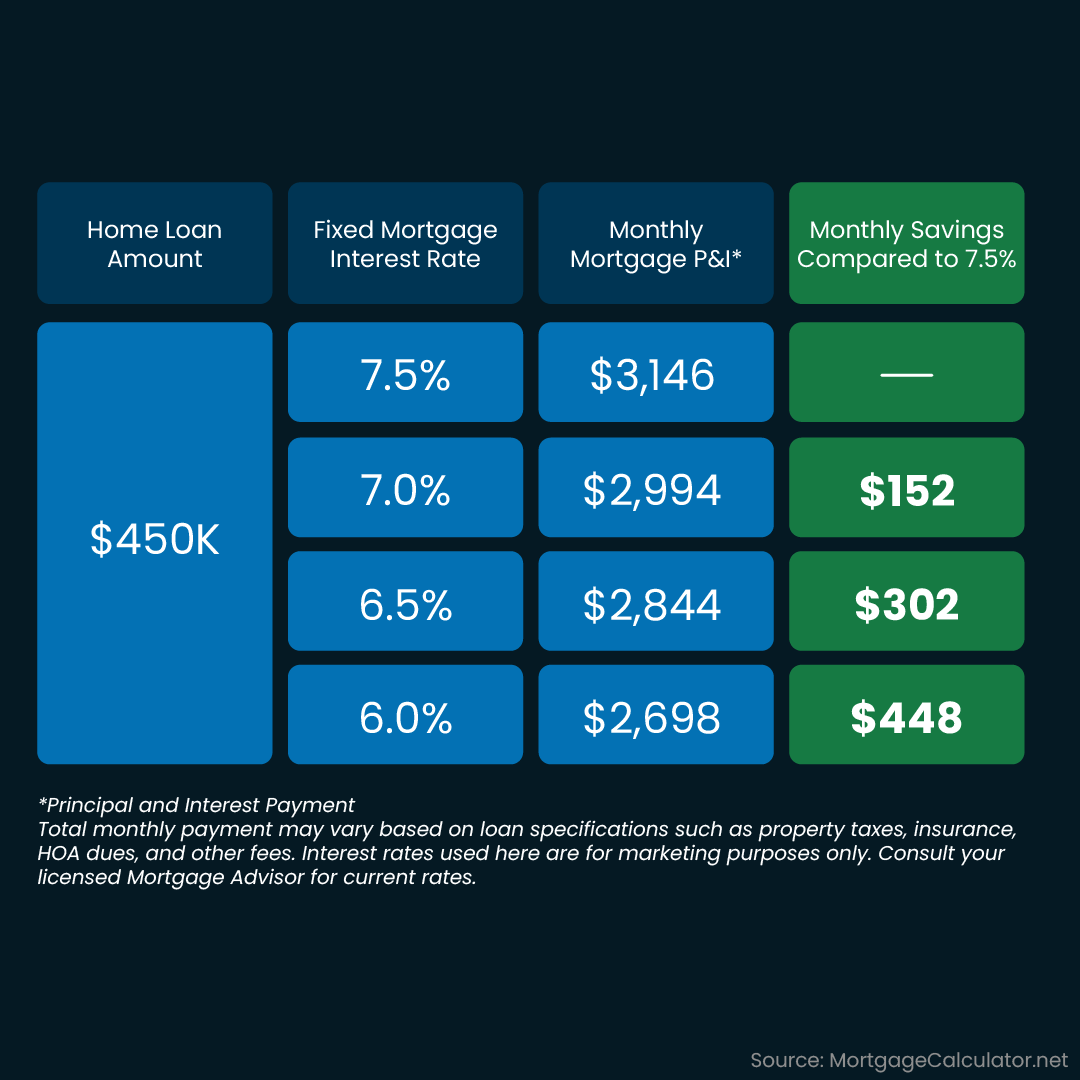

It's also essential to understand the different types of mortgages available. Fixed-rate mortgages offer stability with consistent payments, while adjustable-rate mortgages may start with lower rates that can change over time. Research various lenders and loan programs to find the best fit for your financial situation.

Finally, consider getting pre-approved for a mortgage before you start house hunting. Pre-approval gives you a clear idea of how much you can afford and shows sellers that you are a serious buyer.

By taking these steps to prepare your finances, you'll be well-positioned to navigate the home buying process confidently and achieve your dream of homeownership.

Recent Posts

Broker Associate | License ID: 35464 | 46509

+1(720) 314-8462 | sandy@jonesteamcolorado.com