Buyer Demand Is Rising… Even With Higher Mortgage Rates?

Something surprising just happened in the housing market.

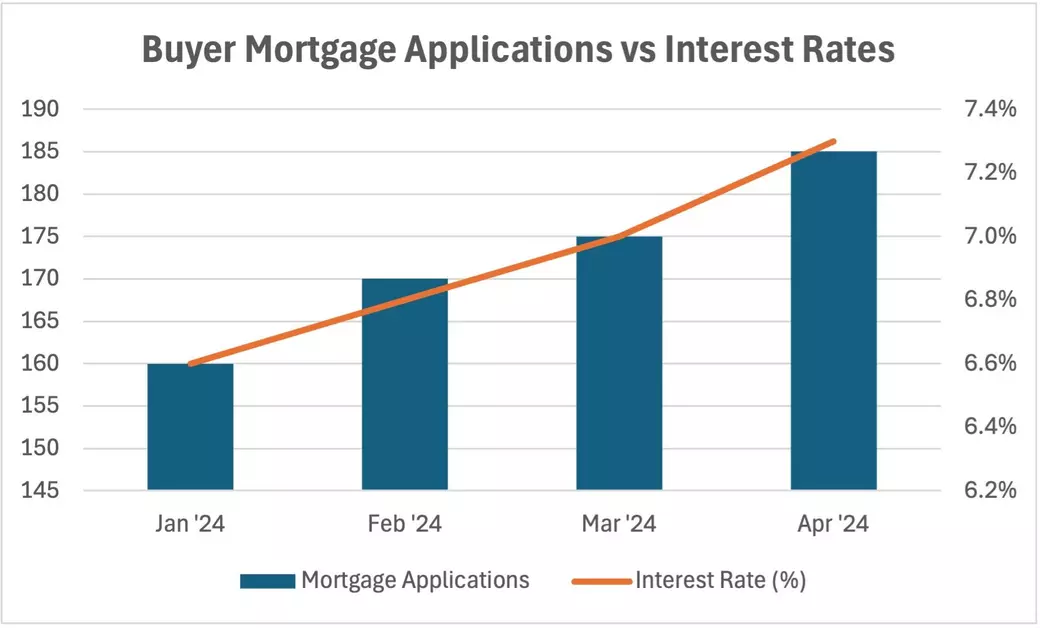

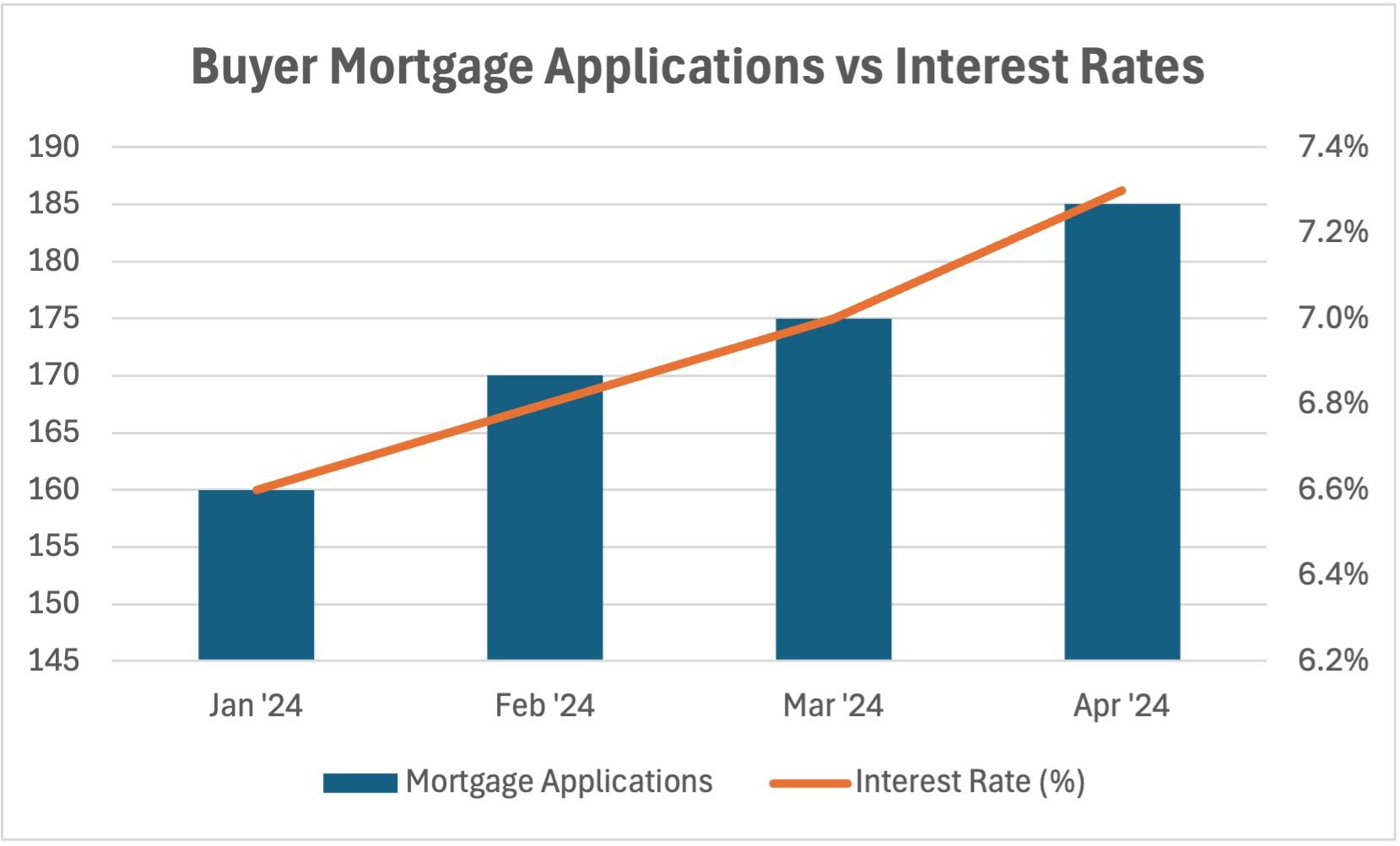

Mortgage rates just hit their highest point since January—yet buyer demand actually increased. According to the Mortgage Bankers Association, purchase applications rose 2% last week and are up 18% compared to the same week last year.

Wait... what?

Why Are Buyers Still Jumping In?

Today’s buyers aren’t naive. They're strategic.

They’ve run the numbers. They've weighed the pros and cons. And many have decided that a slightly higher monthly payment is worth it to:

-

Finally get the right space

-

Lock in a home before prices rise again

-

Take advantage of price cuts and motivated sellers

These aren’t just first-time buyers. We’re seeing it across all price points.

And here’s the kicker: this trend might accelerate through summer.

What’s Happening on the Seller Side?

If you’re a homeowner who’s been sitting on the sidelines, here’s what you should know:

📉 38% of listings are seeing price cuts

📦 Inventory is up 32% year-over-year

(Source: Altos Research, via HousingWire)

In plain English: Sellers are getting realistic. Many are open to:

-

Price negotiations

-

Flexible closing timelines

-

Even covering some buyer closing costs

No, homes aren’t being given away—but this isn’t the market we had in 2021. There’s room to talk, to strategize, and to win—on either side of the deal.

What This Means for You

Whether you're buying, selling, or just thinking about it, this market has opportunities—if you know where to look and how to move.

📬 Got questions about the summer market? Curious about what your home might sell for—or what your buying power really looks like?

Just reach out. No pressure. No pushy sales tactics. Just honest, local insight.

Recent Posts

Broker Associate | License ID: 35464 | 46509

+1(720) 314-8462 | sandy@jonesteamcolorado.com