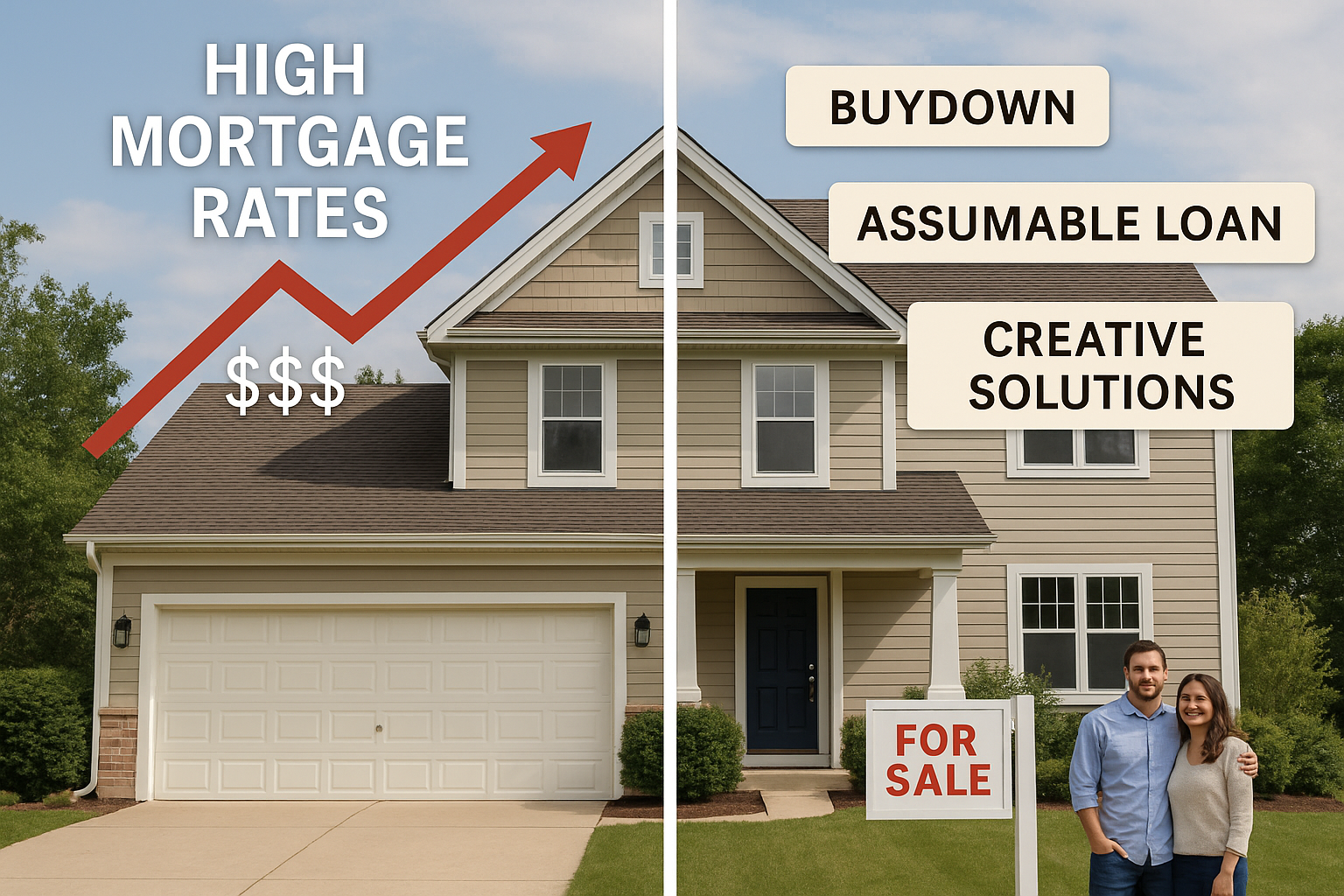

Housing Affordability Now: 50-Year Mortgages, Portable Loans, and Assumables—What Helps and What Hurts

Introduction

Housing affordability is the headline, the headache, and—if you’re strategic—the opportunity. Over the past two years, buyers and sellers have had to navigate eye-watering rates, low inventory, and a market split between folks sitting on sub-4% mortgages and those who have no choice but to move. In that squeeze, a handful of “solutions” have been floated or revived: 50-year mortgages, portable mortgages, and assumable loans—plus tried-and-true tools like 2/1 buydowns, down payment assistance (DPA), and targeted tax credits.

This article breaks down what each option really does to your monthly payment, your equity, and your exit strategy. You’ll get plain-English pros and cons, practical how-tos, and a sober read on what’s being considered at the national level versus what you can actually use right now in Colorado and beyond. The goal is simple: help buyers and sellers make better decisions today without gambling on tomorrow’s rate.

Tim’s take (the lens for this piece): Extending terms to 50 years barely nudges monthly payments and kneecaps equity growth. Smarter plays: portability and assumables where they’re viable, plus tactical rate buydowns (including creative uses of incentive funds) while we wait for supply to catch up and rates to drift lower.

👉 Have questions about your options? Reach out anytime — I can walk you through which affordability tools make sense for your budget and timeline.

Key Takeaways

50-year mortgages shave payments only modestly—but slash equity growth. The longer term looks helpful on paper, but it mainly increases lifetime interest and makes moving or refinancing trickier.

Portable mortgages could reduce “rate lock-in,” letting sellers carry a low rate to their next home—if lenders and investors actually adopt standardized rules.

Assumable loans (FHA/VA/USDA) already work today and can be a game-changer for qualified buyers—but you’ll need a plan to bridge the seller’s equity.

Temporary buydowns (like 2/1) are practical now, especially when funded by sellers/builders, but you must be able to afford the reset rate.

DPA, tax credits, and program expansions (e.g., USDA, CHFA) can stack with buydowns to shrink cash-to-close and payments without sacrificing equity.

50-Year Mortgages—Why They’re a Mirage for Most Buyers

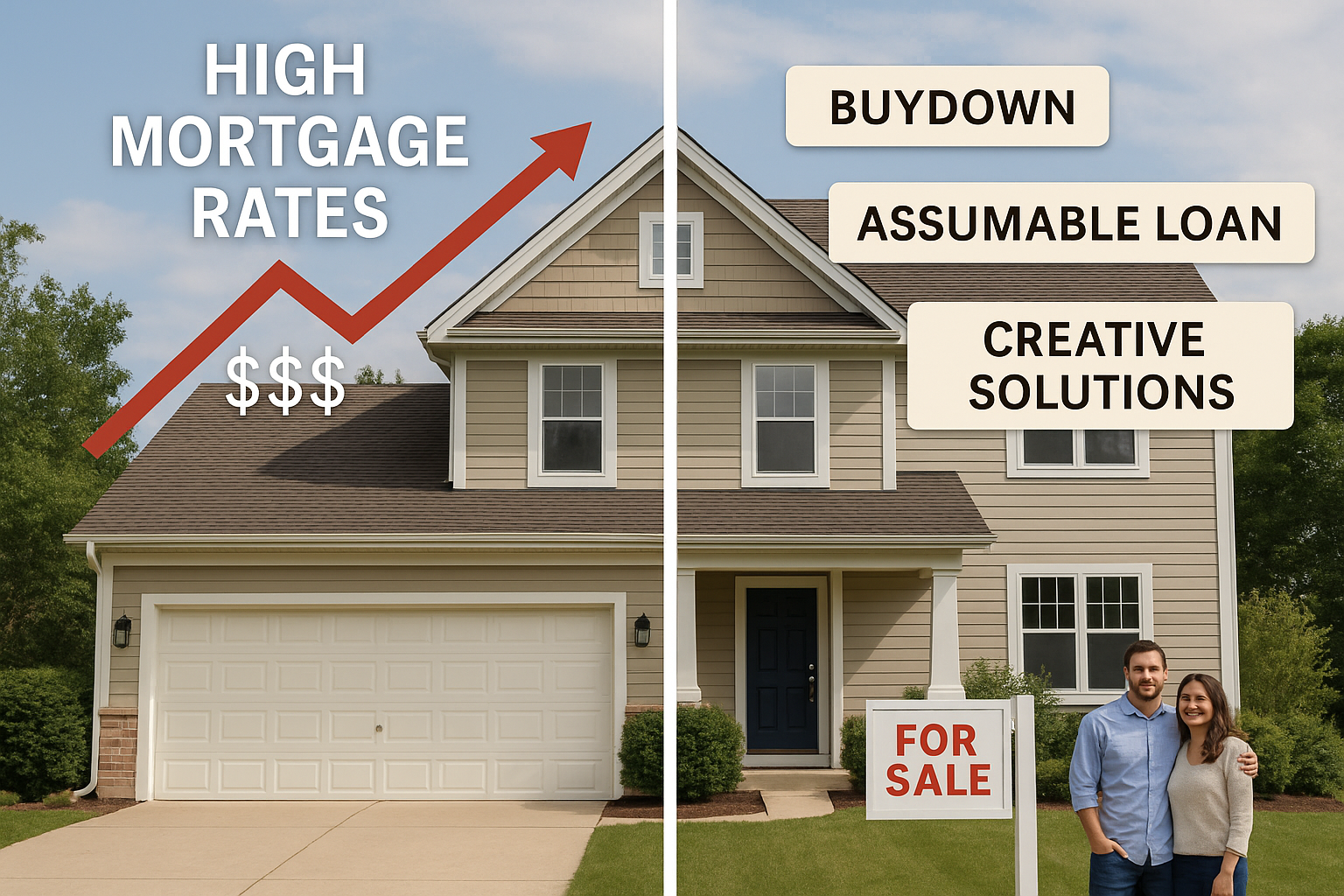

The idea of a 50-year mortgage sounds like an affordability breakthrough—but the math tells a different story. Stretching your term adds two extra decades of payments for surprisingly little short-term relief. Here’s how that plays out in real numbers:

| Loan Amount | Rate | Term | Monthly P&I | Total Interest | Time to 20% Equity* |

|---|---|---|---|---|---|

| $500,000 | 6.5% | 30 yrs | $3,160 | $637,000 | ~9 years |

| $500,000 | 6.5% | 40 yrs | $2,960 | $921,000 | ~13 years |

| $500,000 | 6.5% | 50 yrs | $2,840 | $1,204,000 | ~17 years |

*Approximate, assuming standard amortization with no extra principal payments.

At first glance, that 50-year loan cuts the monthly payment by just over $300 compared to a 30-year—but at the cost of paying nearly double the interest over the life of the loan. Even worse, equity builds so slowly that you could own the home for a decade before you’ve gained more than a modest slice of ownership.

Why It’s Gaining Attention

Housing affordability is strained nationwide, with median home prices near record highs and mortgage rates hovering around 7%. Policymakers are under pressure to “do something.” Extending the mortgage term looks like an easy lever to pull—especially since Japan and parts of the UK have versions of ultra-long loans.

Why It’s a Mirage

Minimal relief: A $300/month drop doesn’t radically change affordability for most buyers.

Equity erosion: When appreciation slows or reverses, low-equity homeowners are more exposed.

Lock-in trap: Long terms discourage mobility; you’re less likely to move or refinance when progress feels glacial.

Lifetime cost: Paying $1.2 million to borrow $500,000 is not a wealth strategy—it’s a rent-to-own at a banker’s pace.

What Buyers Should Do Instead

If the goal is to manage payment pressure, consider:

2/1 buydowns for short-term relief with an exit plan.

Assumable loans where available—real, not theoretical, savings.

DPA or tax credits to reduce upfront costs rather than stretching debt forever.

Bottom line: A 50-year mortgage is like refinancing your student loans into your grandkids’ lifetime. It looks like affordability on paper but robs your future equity and flexibility.

👉 Thinking about stretching your mortgage term? Before locking in a 40- or 50-year loan, let’s run the real numbers on payment vs. equity.

Section 2: Portable Mortgages—Promising, But Not Yet Plug-and-Play

Portable mortgages are a simple idea that run into complicated plumbing. In theory, you move and your low rate moves with you. In practice, the loan sits inside a web of servicing contracts, investor rules, and mortgage insurance terms that weren’t built with portability in mind. Still, pressure from "rate-locked" owners is forcing the conversation.

What Portability Could Look Like in the U.S.

Portability can take a few forms:

True Port: You keep the same note, same rate, and transfer it to a new property (subject to re-qualification, property approvals, and timing windows).

Rate Port: You don’t move the old loan, but you’re allowed to carry the old rate onto a new loan for your next home, typically up to the remaining balance; any additional amount is priced at the market rate.

Blend-and-Extend: A lender blends your old rate with current market rates across a new balance and restarts a fresh term (e.g., blending 3.25% with 7.00% to land near ~5%).

Why Buyers & Sellers Should Care

Breaks Rate Lock-In: Homeowners with sub-4% rates can move without leaping to today’s rates.

Unlocks Inventory: More sellers list, giving buyers choices and easing price pressure.

Smoother Life Events: Job relocations, growing families, or downsizing become financially feasible again.

The Fine Print

Re-qualification is required under current underwriting.

Loan size caps may limit how much of your old rate you can carry.

Timing windows typically require closings within 60–120 days.

Property rules still apply for occupancy and appraisal.

Fees & admin friction are expected until servicers streamline processes.

A Realistic Payment Example

Scenario: You have a $420,000 balance at 3.25% on Home A and want to buy Home B for $700,000.

Port/Rate Portion: $420,000 at 3.25%

New Money: $280,000 at 7.00%

Blended Rate: mid-4% range, far cheaper than 7% on the full amount.

Denver Notes

CHFA and most local lenders don’t offer true portability yet. Watch for pilots from builder lenders or select banks testing “rate port” or “blend-and-extend” features.

Bottom line: Portability is the right idea with the wrong infrastructure—so far. Track pilots and be ready to act where lenders offer it.

👉 Curious if portability might be available through your lender? I can help you check pilot programs and compare them to current assumable or buydown options.

Section 3: Assumable Loans—Working Now (with Smart Structuring)

While 50-year mortgages and portability are still theoretical for most buyers, assumable loans are real, usable, and powerful—especially in a market where existing homeowners hold the golden ticket of a 2.75% to 3.5% mortgage rate. FHA, VA, and USDA loans already allow qualified buyers to assume the seller’s current loan terms. Done right, this can shave hundreds off a monthly payment compared to new financing.

The Mechanics

Assumption means a buyer takes over the seller’s loan balance, interest rate, and remaining term. It’s not a refinance, but a transfer—subject to lender approval and standard credit and income checks.

Real-World Example

| Scenario | Rate | Balance | Term | Monthly P&I |

| New Loan Today | 7.0% | $450,000 | 30 yrs | $2,995 |

| Assumed 2021 Loan | 3.0% | $450,000 | ~27 yrs | $2,135 |

| Monthly Savings | ≈ $860 |

That’s nearly $10,000 per year in savings for as long as the loan remains in place.

The Equity Gap Problem

Most sellers owe far less than market value, leaving buyers to cover the difference.

Example: Seller owes $300K, sells for $525K → Buyer must cover $225K via cash, DPA, or secondary financing.

Tactical Playbook

Verify loan type and balance early.

Get pre-qualified with the servicer.

Plan second-lien financing or DPA for the gap.

Sellers should highlight “Assumable FHA/VA loan at X%” prominently.

VA Tip: Non-veteran buyers tie up the seller’s entitlement until refinance. Veteran-to-veteran transfers are cleaner.

Denver Trend: Assumables are gaining traction. Listings that showcase sub-4% assumable rates see higher traffic and faster offers.

Bottom line: Unlike 50-year or portable loans, assumables aren’t theoretical—they’re actionable now. In a 7% rate world, that’s not just affordability; it’s opportunity.

👉 If you’re selling with a low-rate FHA or VA loan, you’re sitting on a marketing goldmine. Let’s make sure you’re advertising it correctly to attract motivated buyers.

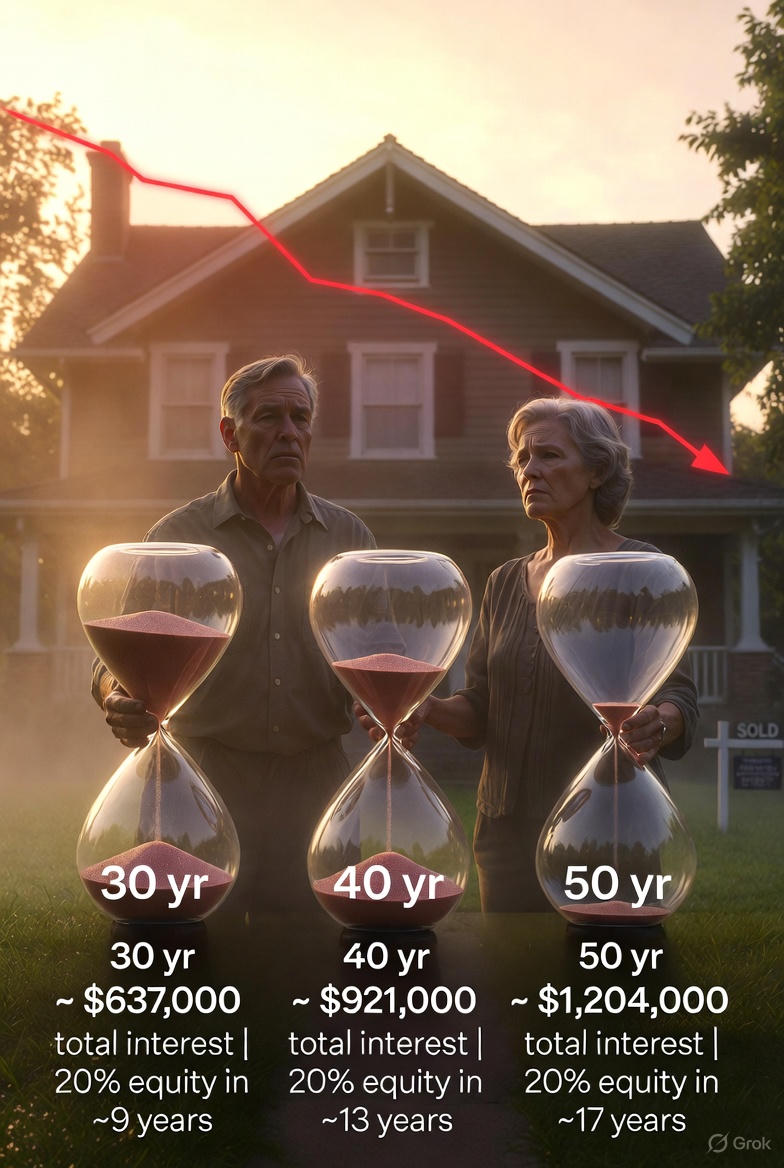

Section 4: 2/1 Buydowns—Bridge the Payment, Don’t Bet the Farm

A 2/1 buydown reduces your interest rate by 2% in year one and 1% in year two before reverting to the full note rate. The cost is often covered by the seller, builder, or lender.

| Year | Rate | Payment | Annual Savings vs. 7% |

| 1 | 5% | $2,684 | $4,488 |

| 2 | 6% | $2,998 | $1,932 |

| 3–30 | 7% | $3,330 | – |

Benefits

Immediate payment relief.

Often seller-funded.

Provides breathing room until refinancing or income growth.

Risks

Payment resets after year two.

Underwriting still uses full note rate.

Only works if you can handle full payment later.

Denver Tip: Builders love buydowns—they attract buyers without cutting prices.

Bottom line: If you can afford the full note rate and use the first two years to build savings, a buydown is the perfect bridge to better rates.

👉 Want to see how a 2/1 buydown could change your payment? I can model it with your numbers in minutes.

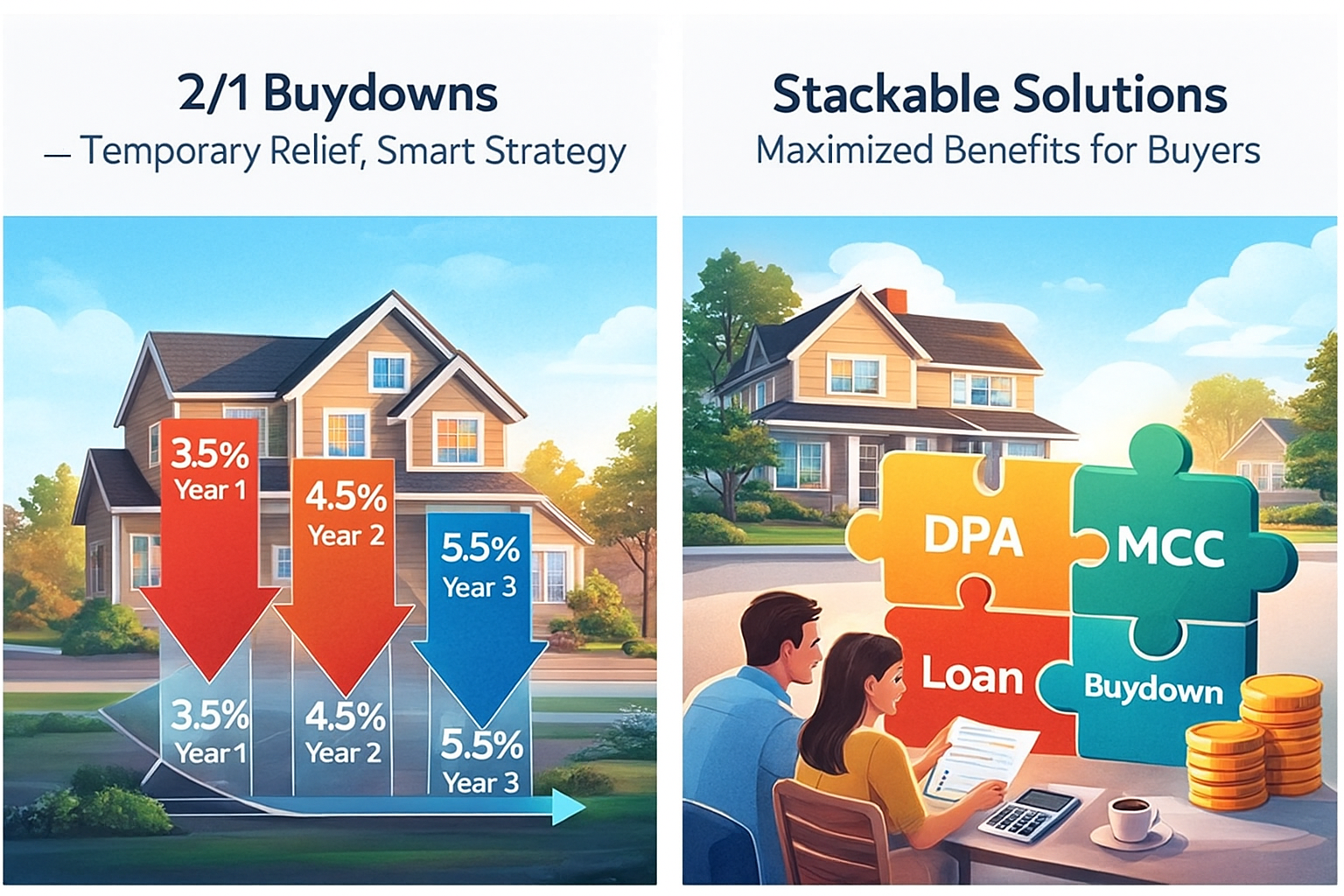

Section 5: Stackable Solutions—DPA, Tax Credits, and Program Tweaks

Stacking programs is the real key to affordability. Combine DPA, MCCs, and temporary buydowns for maximum benefit.

CHFA Programs provide 3–5% down payment help via grants or forgivable seconds. Pairing CHFA with seller credits or 2/1 buydowns can reduce both upfront and monthly costs.

Tax Credits: MCCs allow 20–40% of mortgage interest as a direct credit—worth up to $2,000 annually.

Program Expansions: USDA and CHFA could widen eligibility with temporary cap increases, helping buyers in fringe metro zones.

Smart Stack Example: CHFA DPA + 2/1 Buydown + MCC = $15K–$20K total benefit in first two years.

Bottom line: Layering programs beats waiting for Washington. The tools exist—use them together.

👉 If you’re a first-time buyer in Colorado, I can show you exactly which CHFA or DPA programs you qualify for—and how to stack them for maximum impact.

Section 6: Who Should Use What (Decision Guide)

Each tool fits a different profile:

First-time buyers: DPA + 2/1 buydown + MCC

Move-up sellers with low rates: Assumables or future portability

Sellers with low-rate loans: Market the assumable feature

Buyers needing payment relief: Temporary buydowns

Equity-focused buyers: 15–20 year terms

Tim’s Take: Mix short-term relief (buydowns, DPA) with long-term stability (assumables, equity-friendly terms). Focus on total cost, not just the monthly number.

👉 Need a customized affordability game plan? Let’s review your situation and map out the right combination of tools for your goals.

FAQs—Addressing the Follow-Up Questions Buyers and Sellers Are Asking

1. How much does a 50-year mortgage actually reduce my payment? About $300 monthly on a $500K loan—but at the cost of nearly $600K extra in interest.

2. Can I combine an FHA assumption with a 2/1 buydown or DPA? Yes, with lender coordination.

3. What happens to a veteran’s entitlement when a loan is assumed? It remains tied until the new buyer refinances or sells.

4. How can I find assumable loans in Colorado? Ask your agent to filter MLS for FHA/VA/USDA loans from 2020–2022.

5. Are portable mortgages available now? Not widely—limited pilot programs only.

6. Are there income limits for CHFA or DPA? Yes, roughly $150K for most Denver-area households.

7. How can sellers make their listings more attractive? Promote assumability and buydown credits upfront.

8. What’s the best short-term strategy until rates drop? 2/1 buydown + DPA + smart budgeting.

9. Should I wait for rates to fall? Not if your housing needs are pressing—equity can grow while you wait.

10. Where can I learn more? Reach out directly for a personalized affordability plan.

Final Thoughts...

Affordability isn’t about waiting for perfect timing—it’s about using the right tools available right now. Whether you’re a first-time buyer, move-up seller, or investor, creative structuring can make the market work for you.

I help Colorado buyers and sellers navigate these exact challenges—evaluating assumptions, buydowns, and DPA strategies tailored to your goals.

👉 Have questions about your next move? Let’s connect today to build a plan that fits your timeline and budget.

Check out this article next

Denver Metro Housing Market Update – October 2025

October brought another steady month for Denver Metro real estate. Prices held firm with a median of $590,000, only 1% lower than last year, while…

Read Article